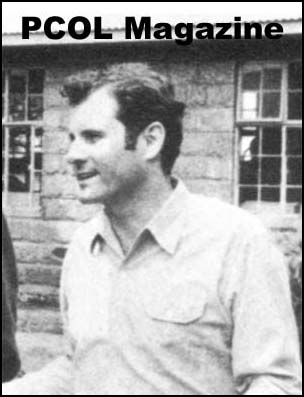

Over the next decade, Blatchford's Peace Corps-inspired program of community activism evolved into one focused on providing the urban poor with economic opportunity through small loans. Since 1973, it has served about 1.5 million clients throughout Latin America. Joe Blatchford was the third Director of the Peace Corps serving under President Nixon from 1969 to 1971.

Accion New York is a branch of Accion International, founded in 1961 by University of California law student Joseph Blatchford, who was haunted by the poverty he had seen in Latin America

Third world lending at work here

Accion International and others like it deal in loans - as little as $500 - too tiny for most banks.

By Henry Goldman

INQUIRER STAFF WRITER

Originally published Oct. 11, 1998

It isn't much - a tiny hole-in-the-wall operation in Queens, some stools, and a counter unremarkably positioned on a street of busy bodegas and variety stores.

But the air inside El Gran Pan de Queso is lavishly, deliciously redolent of empanadas, chicken, sausages and, best of all, arepas. It is on these arepas, cornmeal patties smothered in butter and cheese, that Colombian immigrant Carlos Aldana and his wife, Luz Angelica, have built their dreams.

Since the Aldanas started their restaurant five years ago, word of their arepas has traveled far beyond Jackson Heights. With the help of several small loans from an innovative financial organization, they have expanded their kitchen into a factory that can turn out 125,000 arepas a month. Weekly, Aldana sets out in his truck to distribute boxes of arepas to 200 grocery stores throughout New York City.

He says he never could have done it without the loans he got from Accion New York, one of a growing number of so-called microlenders that are applying Third World antipoverty strategies in struggling urban American neighborhoods.

Accion New York is a branch of Accion International, founded in 1961 by University of California law student Joseph Blatchford, who was haunted by the poverty he had seen in Latin America.

Over the next decade, Blatchford's Peace Corps-inspired program of community activism evolved into one focused on providing the urban poor with economic opportunity through small loans. Since 1973, it has served about 1.5 million clients throughout Latin America.

Accion, which has U.S. programs in Chicago, San Diego and New York, as well as in New Mexico and Texas, is not the only Third World microlender to export this strategy to the United States. Grameen Bank of Bangladesh, a leader in the microcredit movement for two decades, signed contracts last year to manage programs in Harlem and in Tulsa, Okla.

Microlending can be found in Philadelphia as well. Several institutions offer microloans to small businesses, including the Philadelphia Commercial Development Corp., Philadelphia Development Partnership, the Hispanic Microloan Fund, Women's Opportunity Resource Center, Lutheran Children's Family Services Neighborhood Development Project, and the Ben Franklin Enterprise Fund.

``The field of community-development finance has been experiencing a real baby bull market, and Accion International is one of the biggest ,'' says Mark Pinsky, executive director of Philadelphia's National Community Capital Association, an industry support group. ``There's been a tremendous boom in nonprofit intermediaries that serve small borrowers. ''

Six-year-old Accion New York has its headquarters in Williamsburg, a Brooklyn neighborhood that has a large Latino population.

This is where applicants are evaluated for loans as small as $500 and, rarely, as large as $25,000. The average is about $3,000.

Among Accion's 465 current clients are restaurateurs, caterers, seamstresses, bakers of wedding and birthday cakes, street vendors, ice-cream-truck operators, limousine drivers, candy-makers, cosmetics vendors, artisans and craftsmen, mattress collectors, delivery workers, and clothing-store owners.

About 40 percent are women. About 90 percent are Latino.

``We have a business approach with a social mission,'' says Terri Ludwig, 28, a graduate of Harvard's Kennedy School of Government who left what she described as an ``unrewarding'' bank job last year to become director of Accion New York. ``Without our loans to help foster these individual enterprises, many of our clients would sink below the poverty line. ''

Supporters of such programs as Accion have a grand dream: to change the world, one loan at a time.

``These little businesses are critically important to the local neighborhood,'' says William Burrus, Accion International's vice president for U.S. operations. ``They provide goods and services, and serve as role models for youth, demonstrating that you can earn an honest living, have dignity, and support a family by having your own business.

``It's a very powerful message in some of these neighborhoods, where youngsters see a lot of other ways of making a living. ''

Surveys taken in New York of Accion clients with three or more loans showed that by the time they paid off their final debts, their monthly profits had increased 64 percent and their net income 37 percent, from an average of $1,265 to an average of $1,730.

``There's been a big change in my life economically,'' says Ruth Guerra, 65, a seamstress who arrived from Colombia to find work at $121 a week in a Queens sweatshop.

Now, after using loans to buy sewing machines, fabric and other supplies, she works at home making elaborate, hand-beaded and embroidered wedding and party dresses that sell for as much as $5,000.

``It's given me a chance to make enough money to buy a house in Colombia, to take care of my family,'' Guerra says.

Unable to speak English and lacking a formal credit history, she says she considered a bank loan out of the question.

``What bank would lend money to me?'' she says.

And she's right, Accion New York director Ludwig says.

``Generally speaking, most banks aren't interested in making a loan for $8,000, let alone for $500,'' Ludwig says. ``It's just not economically feasible for a bank to make a loan that size. Our goal is to build up enough of a portfolio of loans so that we are self-sufficient and paying our expenses through our operations. ''

Accion loans are not painless: They carry an annual interest rate of 16 percent, much higher than the rates at commercial lending institutions. Ludwig says that is justified by the added costs of evaluating and serving the program's high-risk client pool. But the program's default rate is 5 percent, somewhat less than that of most commercial lenders.

And clients much prefer Accion's interest rates to those of neighborhood prestomistas, loan sharks who generally demand 20 percent a month - $200 on a $1,000 loan.

Ludwig says Accion also offers advantages that commercial banks cannot match: Its loan officers speak Spanish, and stress personal interviews and character references over meeting strict financial criteria; and it offers shorter terms and much faster processing of applications.

Aldana, who has borrowed about $40,000 from Accion since 1994 in six loans ranging from $1,000 to the maximum allowable, $25,000, now has a business big enough to qualify him for a bank loan. But he says he will continue to work with Accion, because its streamlined application process saves him time that he'd rather spend working.

``The process is easy. You don't need a lot of bank statements and credit history,'' says Angel Castillo, 38, an Ecuadorean immigrant who has borrowed a total of $11,500 through three loans, enabling him to buy the designer-label inventory he carries in his Queens discount-clothing store.

For Diana Sanchez, 53, a ceramic artist from the Dominican Republic, Accion New York loans have helped pay for clay, molds and a kiln. She uses them to make kitchen decorations that she sells to a housewares dealer.

``Without the loans, this business would have disappeared,'' she says while working one of her 14-hour days in the former meat-processing plant that houses her South Bronx studio. ``I do the work of three, but this is how I like it. I've always worked for myself. ''

So far, Accion has had no trouble borrowing money to lend. Federal law encourages banks to invest in community redevelopment. The real challenge has been finding people to borrow money.

Since its start in 1992, the Accion New York office has lent $6 million in 2,000 transactions. Last year, its 465 loans totaled $1.5 million. Its lending operation paid less than half of its $636,000 costs, with private donations from enthusiastic corporate and foundation supporters covering the rest. Ludwig figures Accion must make at least 1,500 loans a year if it is ever to break even.

Nationwide, Accion has about 1,000 clients. Since 1992, when it started making loans in the United States, it has lent about $15 million to about 2,500 people. The numbers pale when compared with the effect Accion International has had in Latin America, where it grew from 13,000 borrowers in 1987 to more than 340,000 clients last year.

Still, you have to start somewhere, says Burrus, a former Peace Corps volunteer who has been with Accion International since 1973.

``It may not be the answer to poverty,'' he said, ``but it does have a lot of promise. We might not have met our dreams, but we will show some real breakthroughs. The challenge is to do it on a large scale. I remain encouraged by how much we have helped people advance. ''

For Carlos Aldana, who works seven days a week and employs 12 people, advancement is both tangible and intangible. He sees it not only in his increased business but in the fact that he can afford to send his children to the local Catholic school.

``Many of the things that are better in our lives today are not about money,'' he says. ``People treat me with respect, my neighbors and customers. And my children see a dad who is happy and feels proud of himself, and that's good for them.''